The Euler Effect

A New Age of Programmable Onchain Credit

Introduction

Decentralized lending markets have evolved significantly since their early days as novel financial primitives. The earliest lending models largely represented monolithic platforms with fixed risk parameters, and they served as a critical demonstration of just what’s possible when it comes to lending and borrowing onchain. However, it has become increasingly clear that a one-size-fits-all approach to lending no longer meets the needs of a growing and increasingly sophisticated DeFi space. As a result, today’s protocols are actively building innovative solutions to longstanding problems around credit and capital efficiency onchain.

As the market continues to mature, demand is shifting toward more flexible, modular systems, ones that allow users to define risk, customize financial logic, and unlock new forms of capital productivity. Users want finer control over loan terms, collateral management, and liquidation logic, while protocols must accommodate long-tail assets, structured products, and institutional-grade strategies to appeal to more adept participants. Naturally, this shift requires a fundamental redesign of how onchain credit is both created and managed. With the introduction of Euler v2, the Euler Finance protocol takes a meaningful stab at this transition.

Euler represents a unique step forward in the evolution of decentralized credit infrastructure. Rather than functioning as a traditional borrow-lend marketplace, Euler v2 offers a flexible, modular architecture that enables developers to construct bespoke credit markets from the ground up. The protocol introduces a novel architecture centered around the Euler Vault Kit (EVK), which allows anyone to deploy customizable lend/borrow markets for virtually any ERC-20 asset. This approach shifts lending away from protocol-level rigidity and toward user-defined credit design, unlocking new levels of composability and risk customization.

V2 further extends its utility via EulerSwap, a new DEX with a built-in AMM that introduces native swap functionality between vault assets. By integrating directly with Euler’s lending vaults, the protocol unlocks a new level of capital efficiency, as any deposited LP assets can be used to facilitate swaps, earn lending yield, and be used as collateral to borrow other assets simultaneously. This bypasses typical capital fragmentation and allows liquidity to remain productive at all times.

From Monolithic Lending to Modular Credit

The early wave of DeFi lending protocols (e.g., Compound, Aave, and their contemporaries) were essential to establishing decentralized lend/borrow markets. Generally speaking, their models were simple but effective: pool liquidity, standardize risk parameters, and leave it up to decentralized governance to propose, vote on, and implement changes to the protocol. These systems helped bootstrap early DeFi activity, enabling users to lend and borrow assets trustlessly via transparent collateral rules and algorithmic rate adjustments. As a whole they laid a strong foundation for onchain credit, with active loans growing from $350 million to over $20 billion in less than a year during the early summer of 2020.

Active loans across protocols (source: Token Terminal)

However, such monolithic design came with limitations. Interest rate models were relatively static. Collateral types were restricted. Risk parameters were hardcoded at the protocol level and relied on governance decisions to push meaningful changes. As the market continues to mature and more sophisticated users enter the space, these limitations become bottlenecks. Capital allocators increasingly demand precision in their parameters, seeking differentiated collateral ratios, dynamic risk logic, and better composability with other DeFi primitives.

This shift in demand has given rise to a new generation of protocols like Euler, focused not just on offering credit, but on building new credit infrastructure itself. Instead of predefined lending markets, these systems offer frameworks for creating bespoke credit arrangements. This shift presents an interesting philosophical evolution as well, as credit markets may no longer beengineered by protocol developers alone, but by users, builders, and institutions configuring financial logic to meet their specific needs.

Protocol Architecture and Overview

At the core of Euler’s design are two primary components: the Euler Vault Kit (EVK) and the Ethereum Vault Connector (EVC). One can think of the EVC as the operating system that connects vaults, and the EVK as the vault-building kit developers use to create those vaults. Together, they abstract lending into composable building blocks, allowing developers, DAOs, institutions, and others to construct isolated lending markets with their own unique logic, parameters, and risk schemas. The architecture is designed to host a broad spectrum of lending use cases, from retail credit pools to institutional-grade structured finance.

a). Ethereum Vault Connector: The Central Nervous System

The EVC is Euler’s foundational execution layer, enabling interactions across its modular vault system. While individual vaults manage the actual lending logic, the EVC coordinates user interactions across these vaults, acting as the central router for borrowing, collateral management, and cross-vault operations.

At its core, the EVC’s primary role is to mediate between different vaults in the protocol. It links a user’s collateral and borrowing vaults through a controller mechanism, ensuring any action (e.g., withdrawing collateral or taking on new debt) complies with vault-defined solvency rules. This mediation enables complex cross-vault interactions while preserving system safety as a whole.

b). Ethereum Vault Kit: Protocol Building Blocks

The EVK is the core infrastructure for creating lending markets on Euler. Each EVK vault is an extended ERC-4626 contract that functions as a passive lending pool, earning yield by lending assets to borrowers, who in turn pay interest on their loans. Every vault holds a single ERC-20 asset and supports borrowing against deposited collateral under customizable parameters.

Vaults consist of various modular components, including EVaults, the core logic for managing deposits, borrows, and liquidations; IRMs, interest rate models based on utilization rates; price oracles, vault-specific external price feeds; and protocol configurations, the settings for vault fees and other customizable features. Importantly, EVK vaults are inherently composable, meaning users can link them together to build cross-collateralized structures or layered financial products directly within the protocol.

c). Market Design

Euler markets are modular credit environments where lenders supply capital from which borrowers obtain loans. Unlike most protocols, Euler positions composable vaults as a core primitive, enabling builders to create customized markets for diverse use cases. Using both the EVK and EVC, developers can replicate markets similar to those on Morpho, Compound, FraxLend, Aave, and others. With Euler’s composability, builders can deploy vaults that accept collateral from existing vaults in any other market, building environments specifically tailored to diverse capital requirements and risk profiles.

Example of a customized lend/borrow market (source: Euler docs)

Multiple vaults can be linked in various lending and borrowing relationships, with assets used as both collateral and borrowable funds across these vaults (offering cross-collateralization and rehypothecation). With this, Euler breaks away from the rigid market structures of most lending protocols and instead empowers developers to customize their own market designs to fit user needs.

EulerSwap: Unlocking Newfound Capital Efficiency

One of the hallmark new features of v2 is EulerSwap, a new in-house DEX powered by Euler’s lending infrastructure and integrated with Uniswap v4’s hook architecture. EulerSwap is designed to address the inefficiencies of idle capital that plague both lending platforms and automated market makers (AMMs). By merging these two traditionally separate functions, EulerSwap enables vault liquidity to be simultaneously utilized for earning interest, backing loans, and facilitating trades, unlocking newfound capital productivity.

Unlike conventional DEXs that rely on shared liquidity pools, EulerSwap introduces a single-LP architecture, where each liquidity provider manages their own vault and defines a custom AMM curve. This gives LPs the freedom to implement personalized pricing strategies, support asymmetric or single-sided liquidity, and rebalance positions through onchain or offchain logic. Liquidity never leaves the vault, simplifying risk, minimizing operational complexity, and enabling deeper integration throughout DeFi.

A standout feature of EulerSwap is its just-in-time (JIT) liquidity mechanism. When a swap is initiated, the AMM can instantly borrow the output asset by collateralizing the input token, effectively unlocking deeper markets than the underlying liquidity would otherwise suggest. According to Euler, under optimal conditions (e.g., low volatility/pricing risk) this mechanism can simulate up to 50x the depth of a traditional AMM by borrowing against collateral on the fly. To put that into perspective, $1 million in deposits could theoretically support $50 million in notional trading depth under these conditions.

Cumulative swap volume across available Ethereum and Unichain pools (source: Dune)

While still in beta, EulerSwap recently crossed $1 billion in cumulative volume across its currently available pools on Ethereum and Unichain. Support for pools on BNB Smart Chain, Sonic, Swellchain, Base, Arbitrum One, Avalanche, BOB, Berachain, and TAC is to be added in the coming months as well.

Beyond traditional market-making, EulerSwap notably unlocks several potentially advanced use cases:

Token launch support: DAOs introducing new assets (say XYZ) can set up a vault with USDC that generates yield on the USDC side, while simultaneously using JIT to essentially borrow XYZ into existence. This creates instant liquidity without the DAO needing to supply a large amount of tokens up front.

Delta-neutral strategies: Traders can construct hedged positions by posting collateral in Euler vaults, using EulerSwap to take a position, and hedging the risk using borrowing or other hedging mechanisms. Gains and losses can be conceivably canceled out (delta-neutrality), leaving mostly yield. This enables sophisticated risk-managed strategies.

Internal collateral rotation: Users can swap collateral within the Euler ecosystem by moving positions across vaults, eliminating the need to exit to external protocols to make swaps and then redeposit.

Broadly speaking, EulerSwap’s design offers two revenue sources for liquidity providers: swap fees and interest from lending activity. For token projects, it represents a more efficient alternative to traditional liquidity mining, as JIT mechanics generate necessary liquidity and organic trading activity without the need for large up-front capital deployments.

By embedding swapping functionality directly into its lending layer, EulerSwap evolves Euler from an already modular credit protocol into a unified financial infrastructure stack, one where lending, liquidity, and trading are tightly integrated within a programmable framework.

Tokenomics and Value Accrual

The EUL token serves three primary functions in Euler’s protocol:

Governance: EUL tokens grant holders the ability to vote on protocol changes and treasury management.

FeeFlow auctions: EUL is used in auctions to distribute protocol fees.

Rewards: EUL is distributed as rewards (rEUL) to users for participating in the protocol.

The token has a capped supply of 27,182,818 EUL — an intentional nod to Euler’s mathematical constant, e (the mathematician who inspired the protocol’s name).

EUL price (source: Token Terminal)

While Euler vaults are built to generate protocol-level revenue, most currently operate with their fee switches disabled. This strategy prioritizes borrower incentives by keeping lending rates competitive and encouraging market adoption. Despite this, lenders still earn interest, and yield continues to flow to liquidity providers. Over time, as more vaults begin enabling protocol fees, Euler is positioned to capture a larger portion of the interest generated. These earnings are processed through FeeFlow, a reverse Dutch auction mechanism that systematically converts accumulated assets into EUL, creating structured demand for the token.

a). FeeFlow: The Open-Source Auction Module

FeeFlow is Euler’s onchain mechanism for converting protocol revenue into EUL tokens via permissionless Dutch auctions. It fundamentally addresses a common tokenomics challenge: how to convert protocol revenue – often in alternative assets like eUSDC, eDAI, or eWETH – into native token value without relying on discretionary treasury decisions.

The functionality of the FeeFlow system is relatively straightforward. As users borrow capital and pay interest, fees accumulate in vaults across various ERC-20 assets (e.g., eUSDC, eDAI, eWETH, etc.). These accrued fees are then transferred to a designated controller contract for conversion into EUL, which subsequently flows back to the Euler DAO treasury. The DAO can then decide via governance how to use these funds (burn, distribute, or allocate for protocol growth).

As an example, if the protocol collects $10,000 in eUSDC fees, these are auctioned off and bidders compete by offering EUL tokens. The winning bidders receive the eUSDC, and the EUL they post as payment is sent to the DAO treasury. This structure creates recurring buy-side demand for EUL and ensures that non-EUL revenue is reliably converted into treasury-held EUL. In addition, FeeFlow is crucially:

MEV-resistant: A Dutch auction design avoids front-running and predatory execution.

Multi-asset: Any ERC-20 token collected can be auctioned through the system.

Market-priced: Auctions inherently reflect fair market demand for EUL.

When it comes to incentives, Euler uses a mechanism called Reward EUL (rEUL) to drive borrowing and lending activity while minimizing long-term token inflation. rEUL is a locked form of EUL designed to incentivize early adopters of v2. Distributed via a capped emissions schedule (limited to 5% of total supply), rEUL cannot be transferred and only becomes fully liquid over time. Upon claiming, users can immediately access 20% of their rEUL, while the remaining 80% vests linearly into EUL over a six-month period. However, if the user opts to take the upfront 20%, the unvested portion is permanently forfeited and burned. rEUL rewards are based on a user’s past activity during specific epochs and can be claimed at any time (though any unclaimed rewards are burned after 90 days). This structure ensures emissions are reserved for active participants and discourages passive farming, aligning rewards with long-term engagement and supporting healthy growth of Euler’s lending ecosystem.

Protocol incentives comparison (source: DefiLlama)

While some newer protocols rely heavily on aggressive liquidity mining, Euler’s growth appears to be only moderately supported by incentives. With annualized emissions currently sitting at approximately $10.2 million, Euler’s incentives as a proportion of TVL stands at roughly 0.89%, notably higher than more mature protocols like Aave (0.22%), but still relatively in-line with industry averages. This suggests that while Euler’s deposit growth may not be entirely organic, it’s not blatantly outsized, especially in the context of a newer protocol still in its early expansion phase.

Euler’s elevated ratio should be viewed through the lens of protocol maturity. Euler is relatively early in its v2 lifecycle and is actively onboarding users to a novel modular architecture, something that requires partial financial bootstrapping to reach critical mass. Modest emissions can be an effective catalyst at this stage, especially when paired with a product that offers genuine architectural differentiation. As vault proliferation continues and integrations like EulerSwap drive increased activity, the protocol’s long-term growth trajectory is likely to hinge more on utility than on emissions alone.

Protocol vs. DAO fees and revenue (source: DefiLlama)

Taking a look at June of this year, Euler generated approximately $5.07 million in fees across the protocol, with $350,703 (roughly 6.9%) accruing directly to the protocol as revenue. Of that, just $51,338 ultimately flowed into the Euler DAO treasury. With the majority of fee switches remaining off, this highlights Euler’s early-stage monetization strategy: direct the vast majority of fees toward liquidity providers, delivering natural, protocol-native yield without relying on inflationary token incentives. By doing so, the protocol prioritizes adoption and market penetration first, with the ability to then selectively activate more protocol fees at a later time to capture further value for token holders.

Protocol Snapshot

Total value of user deposits and active loans (source: Token Terminal)

Euler’s total deposits have grown significantly over the past year. TVL has increased to nearly $2.5 billion and active loans have surpassed $1.25 billion. This sustained growth represents increasing interest and trust in the protocol, particularly after the March 18, 2023 exploit that resulted in nearly $200 million in temporarily lost funds (the funds were subsequently returned soon after).

Supplied capital and utilization rate (source: Dune)

Euler’s growing deposit base has played a dual role in the protocol’s development: strengthening its capital foundation while simultaneously enhancing overall capital efficiency. As the number of active vaults continues to increase and borrower activity accelerates, Euler has maintained healthy utilization rates, signaling that deposited assets are not sitting idle but are instead being productively used across the protocol. This reflects not just rising demand, but effective market design: vault parameters and incentive structures are successfully aligning lender supply with borrower demand. Looking ahead, the integration of EulerSwap should compound these gains, unlocking additional capital reuse and further increasing efficiency by enabling idle collateral to facilitate swaps simultaneously alongside lending activity.

Euler monthly active addresses (source: Token Terminal)

Active addresses have also shown consistent growth thus far. Given the protocol doesn’t rely excessively on token incentives to drive usage, this suggests relatively organic adoption is taking place, driven by superior capital efficiency and the protocol’s composable value proposition.

One interesting trend emerging involves Unichain recently cementing itself as the chain with the largest number of active users within the protocol. Despite Unichain accounting for just ~6% of total borrow and ~7% of total supply on Euler, it hosts over 6x the monthly active addresses compared to Ethereum (13.7k vs. 2.2k at current levels). This discrepancy suggests that while Ethereum remains the dominant source of capital and overall borrowing activity, Unichain might be driving a higher volume of smaller, more frequent user interactions.

Borrow and supply metrics: Ethereum vs. Unichain (source: Euler dashboard)

One potential factor here is likely the activity around EulerSwap, where Unichain hosts the majority of swap pools (58 total pools compared to Ethereum’s 3 pools), possibly encouraging broader user experimentation and participation (even if the liquidity per pool remains lower). In contrast, Ethereum’s fewer but much deeper pools support larger trades and institutional-sized borrowing, likely skewing the capital distribution. While Ethereum retains its role as the capital backbone of Euler’s lending layer, Unichain’s higher address count may also reflect retail users engaging with LP strategies, vault deployments, or test swaps. When comparing 7-day swap volume, swap pools on Ethereum account for $39.85 million (~60%), while those on Unichain total $26.6 million (~40%). While Ethereum still accounts for more total volume on EulerSwap, it’s clear here that Unichain’s proportional share in swap volume is much larger than its proportional share of the total lend/borrow market in the protocol.

From a product standpoint, Euler has also been shipping new features quickly over the last few months. Aside from EulerSwap, the protocol very recently rolled out several unique features that broaden reach and usability. A native integration into Telegram, announced July 16th, allows users to interact with vaults and view onchain activity directly from the messaging app, creating a smooth UX for both everyday users and power users alike. Second, following an announcement on July 18th, Euler now powers crypto-native credit cards via Brahma, giving users an instant credit line based on Euler collateral balances. This is an exciting use case demonstrating how composable credit vaults can extend into real-world finance. While still early, these developments and others underscore Euler’s broader ambition to serve as infrastructure not just for onchain lending, but for the future of accessible financial services.

Competitive Landscape: How Euler Stacks Up

Euler is ultimately competing in a well-established and crowded lending landscape, long led by dominant players like Aave and Compound. These incumbents maintain strong market positions thanks to early mover advantages, large liquidity bases, and a wide network of integrations across the DeFi stack.

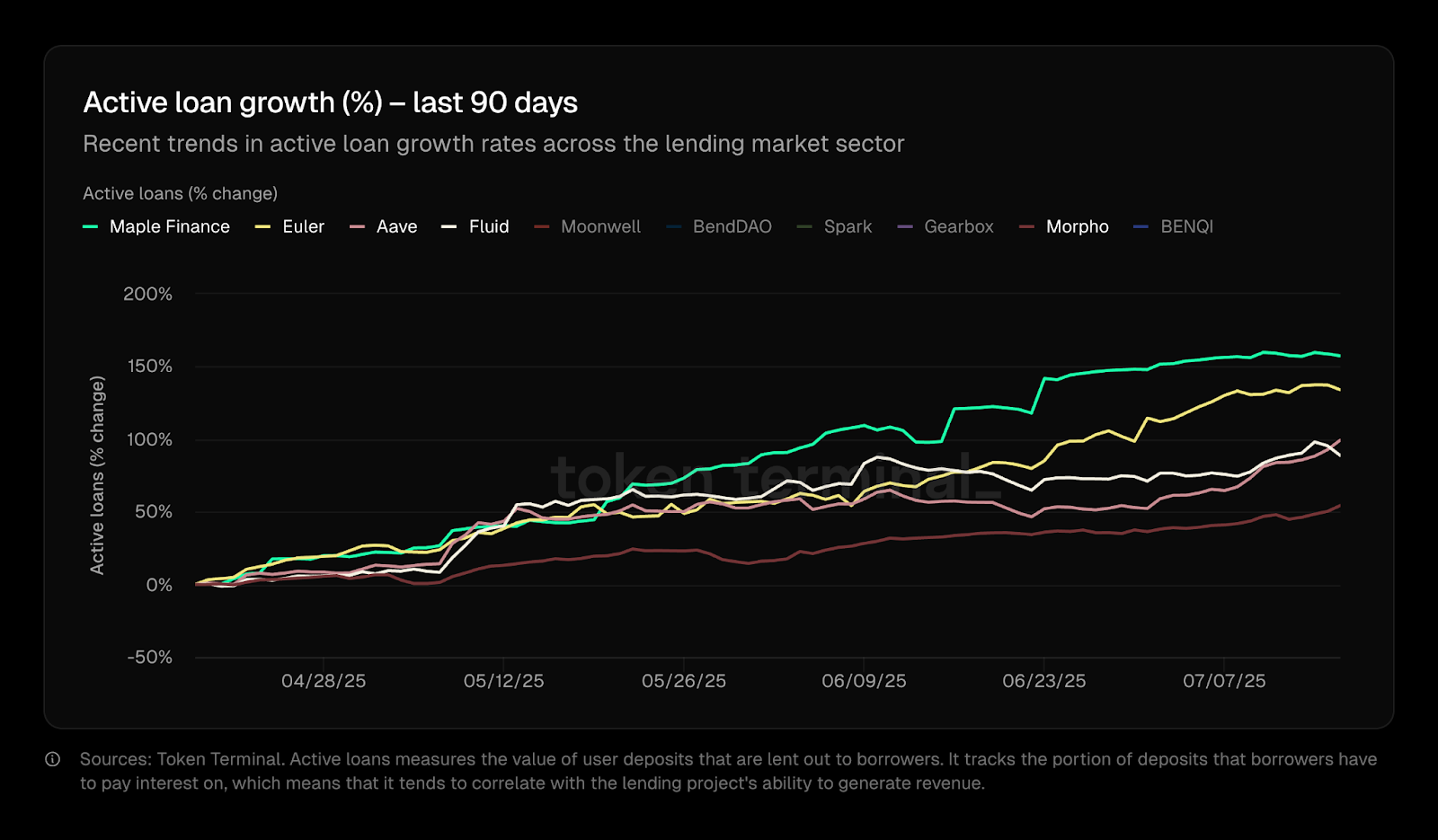

Active loan growth in the lending sector (source: Token Terminal)

Active loans market share by project (source: Token Terminal)

Nonetheless, recent data indicates that Euler is starting to carve out a meaningful market share. Over the last few months, Euler’s share of active loans has grown consistently, driven by increasing adoption of its modular vault architecture. The protocol’s active loans currently hold roughly ~14% market share among notable multichain competitors when excluding Aave (which currently owns roughly 64% of the total lending sector market share in this category).

An important consideration here is that, unlike more traditional lending models, Euler’s customizable credit infrastructure means it can support a broader spectrum of credit use cases, including long-tail assets and more complex borrowing schemes. This theoretically gives the protocol an edge in serving potentially underserved segments of the market and positions it to gain further market share, particularly among sophisticated DeFi players seeking bespoke credit arrangements that legacy protocols cannot support. Importantly, Euler’s differentiation lies not in competing directly on aggregate volume, but by enabling a new iteration of programmable credit.

Lending industry comps (source: Token Terminal)

Average financial multiples (source: Token Terminal)

Turning to some financials, Euler’s current valuation multiples reflect a slight premium among typical lending peers. With an FDV / Annualized Revenue multiple of 87.5x, Euler trades above the peer group average of 77.7x, suggesting that the market is pricing in significant future value accrual. Today’s revenue capture is far from modest, posting annualized revenue nearly on par with Compound and not far behind Fluid, but this premium valuation still suggests relatively high optimism in the protocol’s sustained growth. This optimism is further highlighted by Euler’s roughly 19% premium to the group average FDV/Annualized Fees multiple as well. Being a newer protocol, Euler’s actual revenue capture is among the lowest in the group at ~$370k in 30-day revenue, compared to $10.8 million for Aave and $578k for Fluid. This underscores a clear market thesis: investors are betting on Euler’s infrastructure-driven moat and deferred monetization strategy to bring further value accrual to the EUL token in the future.

Euler’s fees-to-revenue conversion rate is right in-line with many industry peers, but still notably lower than certain leaders like Aave. Euler captures about 10.5% of its 30-day fees as protocol revenue, while some peers like Aave capture closer to 19%. This reflects Euler’s deliberate choice to keep most vault fee switches turned off, directing the majority of fee flows to liquidity providers as natural yield. Despite this, Euler’s valuation multiples are on par or higher than legacy leaders like Aave, which monetize more aggressively. This suggests strong investor belief in the long-term viability of Euler’s modular credit system, and a conviction that eventual fee activation and EUL token value accrual mechanisms will justify these multiples.

It’s important to note also that the EUL token price has increased significantly over the last month, beginning a sharp rally on June 16 that added roughly $116 million to its circulating market cap (+79%). As such, performing a snapshot of Euler’s financials only a month ago would have likely positioned it very differently among its peers in terms of valuation multiples based on its then much lower market cap and FDV. As it stands today, the current market premium Euler enjoys is less about present revenue flows and more a forward-looking bet on protocol architecture, adoption runway, and governance-activated monetization.

Key Risks: What I’ll be Watching

From my perspective, there are a few standout risks Euler faces in its attempt to carve out meaningful market share in the DeFi lending market.

a). Competitive Pressure in a Crowded Market

Euler’s modular credit infrastructure gives it a unique architectural edge, but the DeFi lending market is fiercely competitive—and growing more so. Incumbents like Aave and Compound continue to command substantial market share due to their early-mover advantage, liquidity depth, and trusted brand recognition. And these platforms aren’t standing still. Compound’s v3 (Compound III) and Aave’s upcoming v4 upgrade will incorporate increasingly modular design elements, such as isolated risk markets and enhanced collateral management, directly encroaching on Euler’s differentiation.

Meanwhile, newer entrants like Morpho are taking somewhat of a different approach, leveraging off-chain order flow, direct peer-to-peer matching, and integrations with centralized exchange frontends to offer improved rates and reduced slippage. Hybrid models like these present a credible alternative for capital allocators seeking customization and efficiency, potentially overlapping heavily with the same users Euler aims to serve.

To stay ahead, Euler will need to continuously evolve at the protocol level, extending its vault framework, deepening integrations across DeFi, and refining its UX for developers and institutions alike. Its moat depends not just on the modularity of its architecture, but on the growth of a sticky ecosystem, one where vault deployers, structured product issuers, and sophisticated capital providers rely on Euler’s infrastructure in ways that cannot be easily replicated elsewhere.

b). Monetization Uncertainty and Token Value Realization

Euler has intentionally prioritized adoption over short-term revenue, deferring fee activation to reduce friction and support market growth. While this strategy has helped bootstrap real usage, it has also created ambiguity around value capture for token holders. With the majority of vaults operating with their fee switches off, the DAO is generating only modest protocol revenue, and the EUL token currently accrues limited economic benefit as a result.

Although the infrastructure for monetization is live (primarily through the FeeFlow system, with auctions collecting protocol fees in exchange for EUL) the allocation and utilization of these tokens remains discretionary and subject to DAO governance. This puts EUL in a bit of an awkward position: it’s structurally positioned to benefit from future protocol growth, but its actual utility today is mostly limited to the auction process and governance rights.

Without a clear and compelling roadmap for how EUL will accrue value—whether through staking, revenue sharing, or burn mechanisms—the market may discount its long-term relevance. This lack of clarity could constrain demand for the token, especially among investors seeking near-to-medium-term utility. To shift the narrative from potential to realized value capture, Euler’s governance will need to eventually articulate and execute a more deliberate monetization strategy.

c). Lingering Impact of the 2023 Exploit

In March 2023, Euler suffered a high-profile exploit that resulted in the temporary loss of nearly $200 million in user funds. While the protocol fully reimbursed affected users and handled the incident very transparently, reputational damage on this scale certainly lingers. In the world of onchain finance, perception of security is paramount. For institutional allocators and more conservative users, a single exploit (even if resolved) can serve as a potentially lasting deterrent.

Euler v2 represents a significant leap forward in protocol design, including from a security perspective. Yet regaining trust at scale requires more than technical improvements. It will take sustained demonstration of robust risk management, third-party audits, public disclosures, and transparent governance to fully rebuild confidence in the long run.

Without this, there’s always the risk that Euler’s image is defined not by its current innovations but by its past breach, a narrative that could slow its growth trajectory especially as it seeks to onboard more risk-conscious partners.

Looking Ahead: Euler’s Role in the Future of Onchain Credit

Euler Finance is not just another lending protocol. It’s a foundational infrastructure layer designed for a more modular, customizable, and capital-efficient DeFi economy. By bringing composability to credit markets, Euler has reimagined how onchain lending can scale to meet the needs of increasingly sophisticated users, builders, and institutions.

The protocol’s architectural flexibility allows it to serve a broader spectrum of use cases than most legacy protocols, supporting everything from long-tail asset markets to structured institutional borrowing. Its native integration of swap functionality via EulerSwap further compounds this advantage, turning passive liquidity into active capital across lending and trading functions in a unified, capital-productive system.

Yet, Euler’s story is still being written. Monetization remains early-stage, with most fee switches inactive and the EUL token still largely unanchored to protocol revenue. Governance now faces the important task of defining a sustainable value accrual roadmap that can transition EUL from a governance-heavy token to one with increased economic utility.

Looking ahead, Euler’s long-term success will likely hinge on three critical factors: continued protocol innovation, sustained adoption of its modular vault infrastructure, and the growth of a sticky ecosystem around credit builders and capital allocators. If Euler can continue to execute across these dimensions—while building trust post-exploit and clarifying its token value thesis—it is well-positioned to become a defining layer in DeFi’s next era: one where credit is not just decentralized, but programmable, composable, and tailored to the needs of its users.